Candlestick charts are a powerful, yet simple tool for understanding market direction. But what if you’ve never seen a candlestick chart before? Worry not! This blog post will take you through the basics of how to read this financial indicator(candlestick chart) for beginners.

Ever found yourself lost in the labyrinth of financial markets and trading? Well, let’s dive into the world of Candlestick Charts together. I’m here to guide you through their intricate patterns and help you understand how to read them effectively as a beginner. With my guidance, I assure you’ll have a solid foundation by the time we’re done.

The evolution of candlestick charts can be traced back centuries to Japanese rice merchants. Today, they’ve become an indispensable tool used by traders worldwide. By understanding these types of Candlesticks, you’ll find it easier to predict future price movements based on past trends.

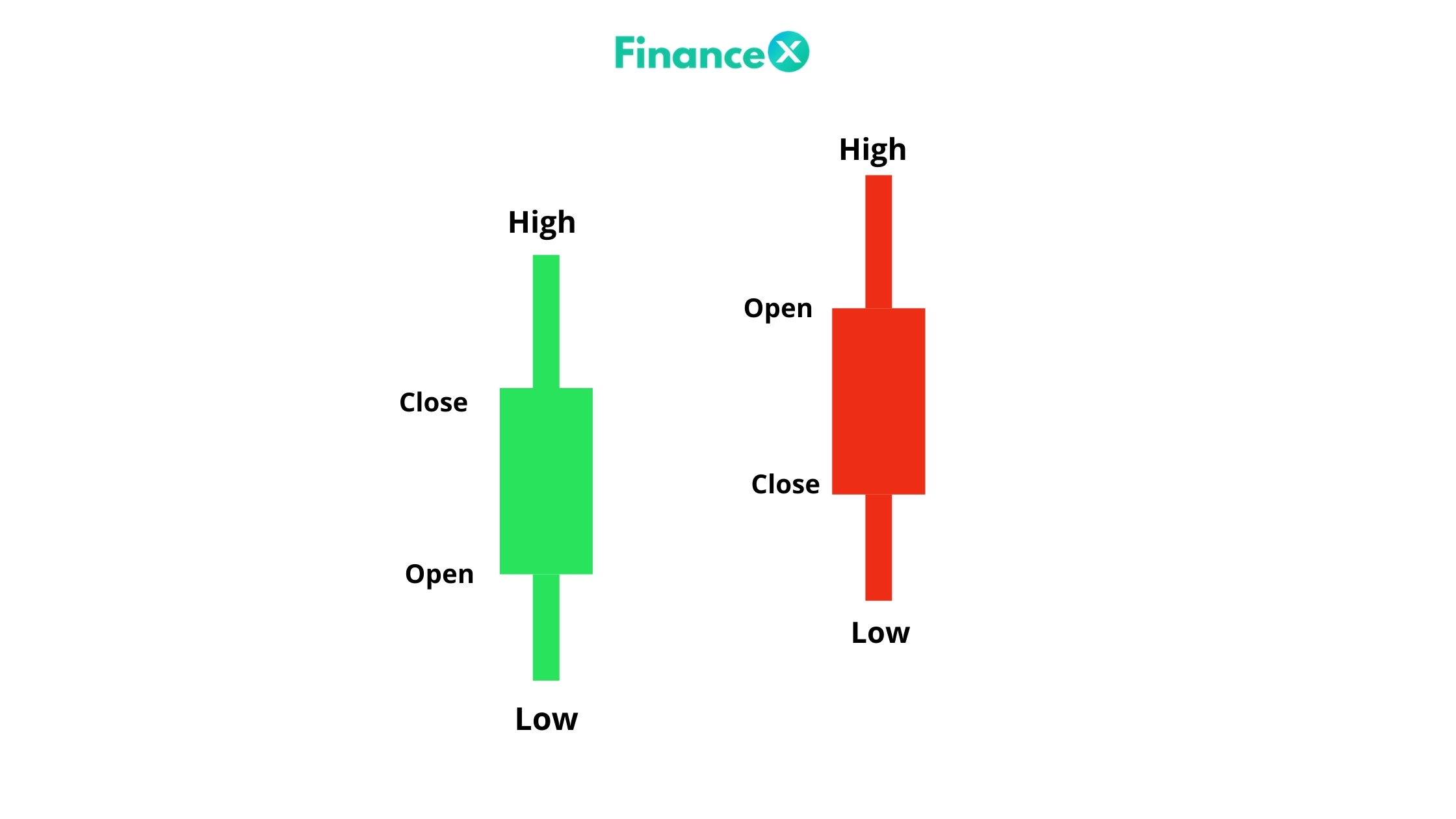

Now, before we get ahead of ourselves, what exactly is a candlestick chart? It’s a type of financial chart used to depict price movements in an asset over time. Each ‘candle’ provides four key pieces of information: the opening price, closing price, highest price, and lowest price within a selected timeframe.

Stay with me as we embark on this journey in unraveling the mystery behind Candlestick Chart Patterns and how they serve as reliable indicators for your trading decisions!

Let us understand this with a simple example. If you see a candle that has an open value of Rs 100 and a close value of Rs 110, it means that there was a demand for that particular stock on that day. The market opened at Rs 100 and moved up to Rs 110.

Understanding the Basics of Candlestick Charts

What is a Candlestick Chart?

The world of stock trading can be a bit intimidating, especially for beginners. But don’t worry, I’m here to simplify things starting with one basic tool every trader needs to grasp – the candlestick chart. Originating over 300 years ago in Japan, this type of chart has become an essential part in financial markets around the globe.

Candlesticks are graphical representations of price movements within a specified time frame. They’re called ‘candlesticks’ because, well, they look like candles! Each candlestick tells a story about the battle between buyers and sellers over a set period.

Elements of a Candlestick Chart

Let’s delve deeper into what makes up these candle-like figures on your screen. A single candlestick consists of four main components:

- Open: This is where the market’s at when it opens.

- Close: Where it ends up when it closes.

- High: It’s peak during that timeframe.

- Low: It’s lowest point.

These are represented by one rectangular body (the real body) and two lines extending from it (the shadows). If you’re thinking this sounds like gibberish right now, stick with me! By understanding these elements you’ll have an edge in spotting patterns in market trends.

Beginner’s Guide to Reading Candlestick Charts

Deciphering these charts doesn’t require any mystical abilities – just some observation and practice. Think of each candle as an emotional tug-of-war between buyers and sellers. When prices rise during a given time frame, we see green (or white) candles forming; conversely red (or black) ones appear when prices fall.

The length or size of the real body can provide important insights too:

- Long green bodies indicate strong buying pressure while long red bodies suggest potent selling pressure.

- Short bodies, on the other hand, represent little price movement and could signal a market indecision or equilibrium between buyers and sellers.

Being able to read candlestick charts is just one part of your trading toolbox. Incorporate it with other tools such as Moving Average, Bollinger Bands, and various trading strategies to decide entry points, stop-loss levels, targets, and quantities. Here at FinanceX we offer stock signals premium which can further aid you in these decisions.

Remember: The key to successful trading is not about predicting the future but understanding the present market conditions!

Types of Candlesticks

Basically, there are 2 types of candlesticks, green and red. However, both of these types of candlesticks contain only one real element, i.e., the high or low value.

1. Green Candle

Green Candle represents the closing price at the end of the time period is higher than the opening price.

2. Red Candle

Red Candle represents the closing price at the end of the time period is lower than the opening price.

Let’s understand this with the image below:

Candle Body

The filled portion of a candle body green/red represents the opening price and the closing price. In a green candle, the upper end of the candle body is the closing price. Whereas, in a red candle, the lower end of the candle body is the closing price.

Candlewick

There’s an upper shadow and a lower shadow in a candle that represents the wick of the candle. This refers to the range of price at which stock was traded over a particular time period. The upper shadow is represented by the part of the candle that lies above the opening price. Whereas, the lower shadow is represented by the part of the candle that falls below the closing price.

Key Elements to Look for in Candlestick Charts

Candlestick charts are a trader’s best friend. They’re packed with information, revealing key insights into market sentiment and potential reversals. Let me guide you through some essential elements to look for when reading these charts.

Understanding Bullish and Bearish Candlestick Patterns

One of the first things you’ll notice about candlestick charts is that they’re color-coded. Generally, green or white candles indicate bullish activity—meaning prices are likely to rise—and red or black suggest bearish trends where prices might fall. But it’s not just about colors; it’s about patterns too!

Bullish patterns like the Hammer, Inverted Hammer, and Bullish Engulfing often signal an upcoming uptick in price, while Bearish patterns such as Hanging Man, Shooting Star, and Bearish Engulfing hint at a possible downtrend. Familiarizing yourself with these patterns can be a game-changer!

Reading the Signals: Key Elements of Candlestick Charts

Candlesticks aren’t just pretty to look at—they’re also incredibly useful! The body of the candle tells us about opening and closing prices during a specific time period while its wicks (or ‘shadows’) show us how far prices have swung within that same period.

Remember to keep an eye on both long and short bodies: Long bodies hint at strong buying or selling pressure (depending on their color), while short ones could mean little price movement.

At FinanceX we offer stock signals premium! This includes access to tools like Moving Average and Bollinger Bands that can help interpret these signals effectively.

Importance of Time Frames in Candlestick Chart Analysis

A major factor that traders often overlook is time frames. Depending on your trading strategy—whether you’re a day trader who makes multiple trades per day, or if you prefer longer-term investments—you’ll want to adjust your time frames in chart accordingly.

Longer time frames can smooth out ‘noise’ and give a clearer picture of overall trends, while shorter time frames may reveal more immediate changes. Either way, don’t forget to decide your entry, stop loss, target, and quantity before you make a move!

Lastly, remember: Trading isn’t just about knowing patterns—it’s also about understanding what they mean in the broader market context. So go ahead—dive into the world of candlestick charts! You’re now ready to start spotting opportunities like a pro.

Understanding Bullish and Bearish Candlestick Patterns

Learning how to read a candlestick chart is an essential skill in the world of trading, but it’s equally important to understand what these patterns mean. In this section, I’ll focus on two main types of candlesticks: bullish and bearish candles.

Bullish Candles: What to Look For

Bullish candles are a trader’s best friend – they signal that prices are likely on an upward trend. When you spot a bullish candle on your chart, it’s time to sit up and pay attention. But what exactly should you be looking for? Here are some key indicators:

- The closing price is higher than the opening price.

- There’s little or no upper shadow (also known as the “wick”).

- The longer the body of the candle, the more intense the buying pressure.

Take note though! Not every green or white candle necessarily means a bullish market. Understanding context and other factors such as volume can dramatically improve your ability to interpret these signals accurately.

Bearish Candles: Key Indicators

On the flip side of our coin are bearish candles – these are essentially warning signs that prices may be headed downward. A typical bearish candle has these characteristics:

- The opening price is higher than its closing price.

- It features a long body with small or non-existent lower shadows.

- If there’s high trading volume during this period, it further solidifies bearish sentiment.

Again, remember that not all red or black candles indicate an impending downtrend; interpreting them within broader market context is crucial!

Candlestick Patterns for Effective Trading

Many successful traders don’t just look at individual candles – they study patterns formed by groups of them over certain periods. These patterns can provide valuable insights into potential future market moves.

Here’re some common bullish and bearish patterns worth knowing:

- Bullish patterns: Hammer, Inverted Hammer, Bullish Engulfing, Piercing Line.

- Bearish patterns: Hanging Man, Shooting Star, Bearish Engulfing, Dark Cloud Cover.

At FinanceX we offer stock signals premium that can help identify these patterns efficiently. However, while using such tools can certainly boost your trading strategy, it’s essential to understand the basics of candlestick chart reading. It helps you decide entry points, stop-loss levels and targets with better precision.

Next up in this guide? I’ll be diving into more sophisticated methods like Moving Average and Bollinger Bands for interpreting candlestick charts. Stay tuned!

Common Candlestick Patterns

Let’s dive right into the core of our discussion – understanding common candlestick patterns. It’s a critical aspect of mastering how to read a candlestick chart. If you’re new to this, it might seem like a tough nut to crack, but let me assure you, with some practice and patience, it’ll become second nature.

Recognizing Common Candlestick Patterns

Candlestick Chart Patterns are diverse; however, certain shapes and formations frequently appear on charts. Understanding these patterns can give us clues about the market sentiment and potentially predict future price movements.

- Bullish Engulfing Pattern: This pattern occurs in a downtrend when a small bearish candle is followed by a large bullish one.

- Bearish Engulfing Pattern: The opposite of the bullish engulfing pattern – shows up in an uptrend when there’s a small bullish candle followed by a large bearish one.

Now that we’ve touched on some commonly seen types of candlesticks let’s discuss them more specifically.

Doji: A Key Candlestick Pattern

Doji – ever heard this term? You’re likely to come across it pretty often if you get into trading using candlesticks. A Doji represents indecision in the market – it forms when the opening and closing prices are equal or very close.

There are several variations of Dojis:

- Standard Doji: Indicates an evenly fought battle between buyers and sellers.

- Long-legged Doji: Shows high levels of volatility with larger price swings.

- Dragonfly & Gravestone Dojis: They indicate strong buying or selling pressure respectively.

Remember that just spotting these patterns isn’t enough. It’s crucial to consider other factors like volume, trends, etc., for better decision-making during trading.

Hammer and Hanging Man: Identifying Reversal Patterns

Adding another feather in your cap today, we’ll understand two key reversal patterns – the Hammer and Hanging Man.

- Hammer is a bullish reversal pattern that forms during a downtrend. It indicates that sellers were in control during the trading session but buyers managed to push the price back up – indicating potential buying pressure.

- Hanging Man, on the other hand, suggests a bearish reversal. It forms when there’s an uptrend and signals possible selling pressure.

Knowledge of these candlestick patterns can prove extremely valuable when used in conjunction with other indicators like Moving Average or Bollinger Bands. Speaking of which, did you know FinanceX offers stock signals premium? It’s something to consider if you’re serious about trading strategies.

Whether it’s deciding entry points, setting stop-loss limits, determining targets, or deciding on trade quantity – understanding candlestick charting can greatly enhance your effectiveness as a trader. So dive in and start practicing today! With time and experience under your belt, reading candlesticks will become second nature. Stay tuned for our next section where we answer some frequently asked questions about Candlestick Chart Patterns!

Practical Tips on Reading Candlestick Charts

Reading candlestick charts doesn’t have to be as complicated as it may first seem. With some basic understanding and a few tried-and-true strategies, you’ll be analyzing like a pro in no time.

Mastering Basic Candlestick Chart Reading Strategies

Candlestick charts are a favorite among traders for their visual appeal and ease of interpretation. The key to mastering these charts lies in understanding the basics.

Each candlestick represents a specific timeframe—be it an hour, day, or even month—and illustrates the opening, closing, high and low prices during that period. The “body” of the candle indicates whether prices went up (bullish) or down (bearish). A bullish candle is usually colored green or white while bearish ones are typically red or black.

Let’s talk about different types of candlesticks:

- Doji: This pattern signifies uncertainty in the market.

- Hammer/Hanging Man: It can signal potential trend reversals.

- Shooting Star/Inverted Hammer: These might indicate upcoming bearish trends.

Analyzing Market Trends with Candlestick Charts

Now that we’ve got those basics down, let’s dive into how to use these patterns for interpreting market trends:

- Spotting Reversals: Keep an eye out for patterns like Doji and Hammers which could imply possible trend shifts.

- Confirming Trends: Patterns such as Bullish Engulfing or Bearish Engulfing can help confirm existing trends.

- Trading Strategies: Use Moving Average lines along with Bollinger Bands for further confirmation before deciding your Entry point, Stoploss position, Target price, and Quantity.

Here at FinanceX we offer stock signals premium service that incorporates these strategies into actionable trade ideas!

The Role of Color in Candlestick Chart Analysis

Color plays an essential role when reading candlestick charts. Generally, a green or white body indicates the price increased during that period—it opened low and closed high—while a red or black body shows that the price fell—it opened high and closed low.

However, it’s not just about color; it’s also about the size of the candlestick body relative to its shadows (the thin lines above and below the body). A long body with short shadows signifies strong buying or selling activity. On contrast, a short body with long shadows suggests indecision in the market.

I hope these practical tips give you a head start on your journey toward becoming proficient at reading candlestick charts. It might seem tricky initially, but remember, practice makes perfect!

Applying Candlestick Analysis in Real Trading Scenarios

Navigating the world of financial markets can be a complex undertaking, but with tools like candlestick charts, it’s made significantly less daunting. Candlestick analysis is one such tool that traders often employ to make more informed decisions.

Implementing Candlestick Analysis in Trading

When it comes to real trading scenarios, understanding how to read a candlestick chart can provide invaluable insights. Each candlestick represents a specific time period and displays the opening, high, low, and closing prices during that interval. The shape and color of the candlesticks signal whether bulls (buyers) or bears (sellers) dominated the market during that time.

Certain types of candlesticks suggest possible future price movements. For instance:

- Doji typically indicates indecision in the market.

- Hammer suggests bullish reversal after a downtrend.

- Shooting star indicates bearish reversal after an uptrend.

By recognizing these patterns, traders can anticipate potential shifts in market sentiment and adjust their strategies accordingly.

Other Candlestick Chart Patterns

There are different types of patterns you can see on a candlestick chart. Candlestick patterns are displaying price information in a market.

Other Bullish Patterns

1. Inverted Hammer

The Inverted Hammer candlestick pattern is very similar to the Hammer pattern, but it’s a reversal candlestick pattern. This means that when a stock is in an upward trend, the opening and closing values are almost equal to one another due to sellers have pushed the prices downwards.

2. Morning Star

The Morning star pattern is formed when there is a bullish trend in the market. This pattern can be found both in a bullish and bearish market. In a bullish candlestick chart, one candle (green) is followed by a red candle that has a small body with an engulfing pattern. The close value of the red candle should be between 90 to 100 percent closed-value of the green candle.

3. Piercing Pattern

When there is an upward trend in stock, the opening and closing price of a stock is equal to one another or any small gap between them. To represent this well, we use a piercing pattern. This pattern is also known as the Doji star.

Bearish Pattern

4. Evening star

The evening star candle shows that there was a strong demand for a stock and supply was met at an earlier point of time during the day.

5. Hanging Man

The Hanging Man pattern is formed when there is an upward trend. This is a bearish reversal candlestick that has a long lower shadow. This means that there was an upward trend in the stock’s price and then it reversed. The long lower shadow of the candle shows that sellers pushed down the prices of a stock and now bulls are not able to push further.

There are more candlestick patterns, such as Engulfing, Harami, Dark cloud cover, etc.So, now you have a basic idea about the candlestick chart. Now let’s learn to read the Candlestick chart.

How to Read Candlestick Chart?

Before making a trade in the stock market, it is essential to analyze the candlestick chart because it gives you a fair idea of how the stock is moving and where it may be headed. If you want to be a successful trader, then you must know how to read a Candlestick Chart.

1. Select the Particular Time Period

The first thing you have to do in the chart is to select a particular time period for which you are looking. Selecting a particular time period is totally based on the type of trading you are doing.

2. Add Moving Average Indicator

Moving Average Indicator

After selecting the time period, the next thing you should do is to add the moving average indicator. Moving Average Indicator refers to the average of a stock over a certain period of time.

For example, if you want to buy a stock with 100 days moving average, then you should enter 100 in the moving average box.

There are many different types of moving averages that can be used in candlestick charts. However, historically the simple 20-day and 50-day moving averages have been quite popular for many trading strategies. They work well to confirm trends in stock prices and help to identify the beginning of trends.

3. Selecting Stocks

Now you should understand the stock’s trend better. If you’re considering buying a stock, ensure its moving average shows an upward trajectory and that the stock price is above this average. Conversely, if you’re thinking of selling, look for indicators like a downward trend.

4. Decide Entry, Stoploss, Target, and Quantity

After you have decided the time period, the moving average, and the stock that you want to buy, then it is time to decide on the price entry. You must buy above/after the green candle that looks bullish and Stoploss below the last 2/4 candles low depending on the most time spent near any particular price levels. Target should depend on the time period you are trading. You should use 10-15% of your total capital on single trade.

How to Improve Your Trades Using Candlestick Charts

Candlestick charts can help improve your trades in several ways:

- They provide visual context, making it easier to spot trends and reversals.

- Candlestick patterns like ‘bullish engulfing’ or ‘bearish harami’ can signal potential entry or exit points for trades.

- By combining candlestick analysis with other technical tools (like Moving Averages), you can build more robust trading strategies.

At FinanceX, we offer stock signals premium that uses sophisticated algorithms to analyze these chart patterns and help traders decide entry, stop-loss, target, and quantity—making the entire process a lot easier.

Frequently Asked Questions(FAQs)

What is a candlestick chart in stock trading?

A candlestick chart is a visual representation of price movements in a specified timeframe. It showcases the opening, closing, high, and low prices during that period, making it a popular tool among traders and investors for deciphering market sentiments.

Why are candlestick charts preferred by traders?

Candlestick charts offer a comprehensive view of market dynamics in a single candle. They not only display price movement but also indicate the strength of buying or selling pressure, providing valuable insights into potential future price direction.

How do I differentiate between bullish and bearish candles?

A bullish candle typically has its closing price higher than its opening price, represented by a (usually) green or white body. A bearish candle closes below its opening price and is often colored red or black.

What’s the significance of the candle’s wick (or shadow)?

The wick (or shadow) of a candlestick illustrates the highest and lowest prices traded during a specified timeframe. A long upper wick indicates rejection at higher prices, while a long lower wick suggests buying pressure at lower prices.

Can you explain the basic difference between a ‘doji’ and a ‘hammer’ in candlestick charts?

Certainly! A ‘doji’ is a candlestick where the opening and closing prices are nearly the same, suggesting indecision in the market. A ‘hammer’, on the other hand, has a small body at the upper end and a long lower wick, indicating that the market is potentially rejecting lower prices.

How can I use candlestick patterns to predict price movements?

While no method is foolproof, recognizing recurring candlestick patterns, like the bullish engulfing or bearish harami, can help anticipate possible future price actions. These patterns are based on historical observations and reflect shifts in market sentiment.

Are there any tools or software that can help beginners with candlestick chart analysis?

Yes, many online trading platforms provide tools for candlestick chart analysis. Features like pattern recognition can automatically highlight potential patterns, aiding beginners in understanding and interpreting market movements.

How long should I practice reading candlestick charts before trading?

Practice duration varies by individual. It’s crucial to feel confident in your ability to interpret the charts and understand market sentiments. Many experts recommend starting with a virtual trading account to practice without financial risk until you’re comfortable transitioning to real trading.

With Candlestick charts, you can find better entry and exit signals and make money in the stock market. Candlestick charts utilize the power of technical analysis in a simple format to help you quickly identify market trends and buy/sell opportunities. The combination of candlestick charting techniques has proven to be an effective method for analyzing data and making trading decisions.

There are several other candlestick patterns that you can follow to understand trends of the market and the sentiment of the markets.

Remember though—it’s crucial not just to know how to read a candlestick chart but also understand what it implies about market sentiments. The key lies in continuous learning and practice until you feel confident applying this knowledge in real trading scenarios. After all, financial markets are as much an art as they are science!

Hey Manish Sharma,

Well-written post. You have shared an awesome content providing easy tips to read candlestick charts for beginners. I really like and appreciate the way you have presented all things in such a easy language making a concept very clear and easy to understand. While scrolling through your post i noticed that you have also discussed about types of candlesticks and various candlestick chart patterns categories that are so clear and easy to understand. You are definitely providing good understanding to your readers. Your each listed steps ( including images ) to read candlestick chart are well-elaborated and easy to follow. Considering these steps will be a great helping hand for user.

After going through this complete guide i gain ideas and am sure that this post will definitely help lots of people and readers.

Fantastic work and keep sharing more similar post.

Thanks,

-Aadarsh